Q4 2022 Western Washington Economic & Real Estate Update

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. I hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

Regional Economic Overview

Although the job market in Western Washington continues to grow, the pace has started to slow. The region added over 91,000 new jobs during the past year, but the 12-month growth rate is now below 100,000, a level we have not seen since the start of the post-COVID job recovery. That said, all but three counties have recovered completely from their pandemic job losses and total regional employment is up more than 52,000 jobs. The regional unemployment rate in November was 3.8%, which was marginally above the 3.7% level of a year ago. Many business owners across the country are pondering whether we are likely to enter a recession this year. As a result, it’s very possible that they will start to slow their expansion in anticipation of an economic contraction.

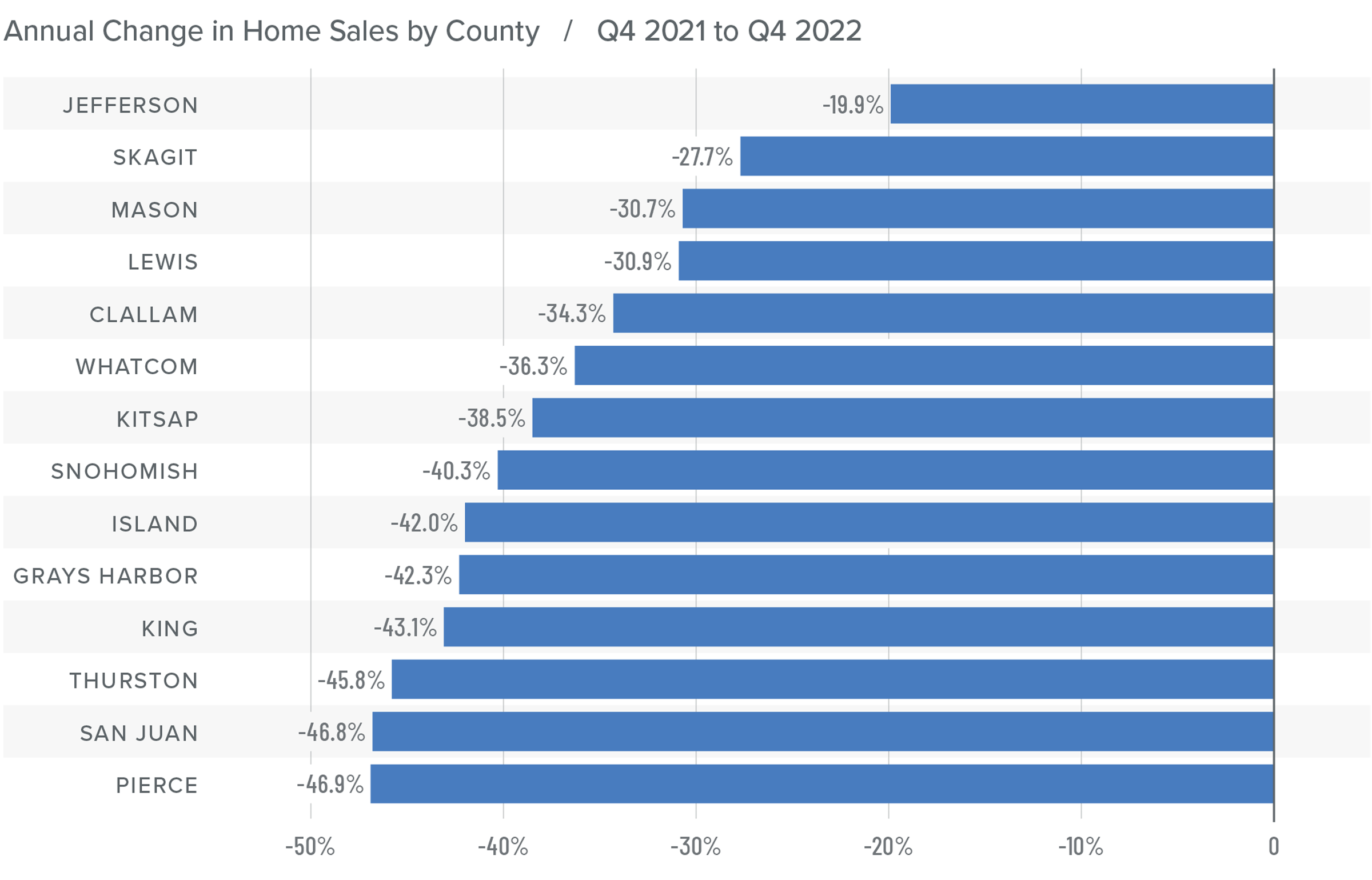

Western Washington Home Sales

❱ In the final quarter of 2022, 12,711 homes sold, representing a drop of 42% from the same period in 2021. Sales were 34.7% lower than in the third quarter of 2022.

❱ Listing activity rose in every market year over year but fell more than 26% compared to the third quarter, which is expected given the time of year.

❱ Home sales fell across the board relative to the fourth quarter of 2021 and the third quarter of 2022.

❱ Pending sales (demand) outpaced listings (supply) by a factor of 1:2. This was down from 1:6 in the third quarter. That ratio has been trending lower for the past year, which suggests that buyers are being more cautious and may be waiting for mortgage rates to drop.

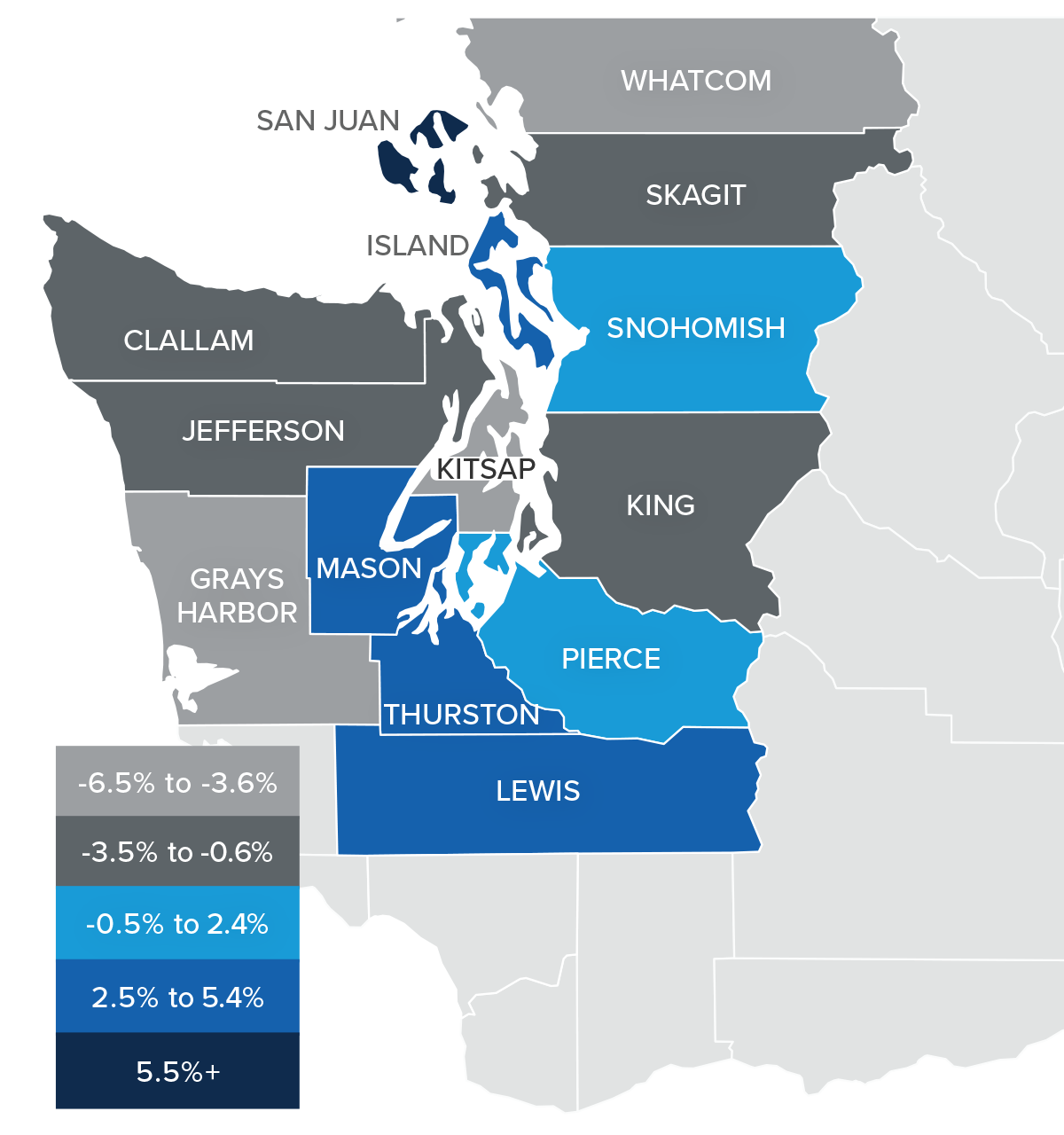

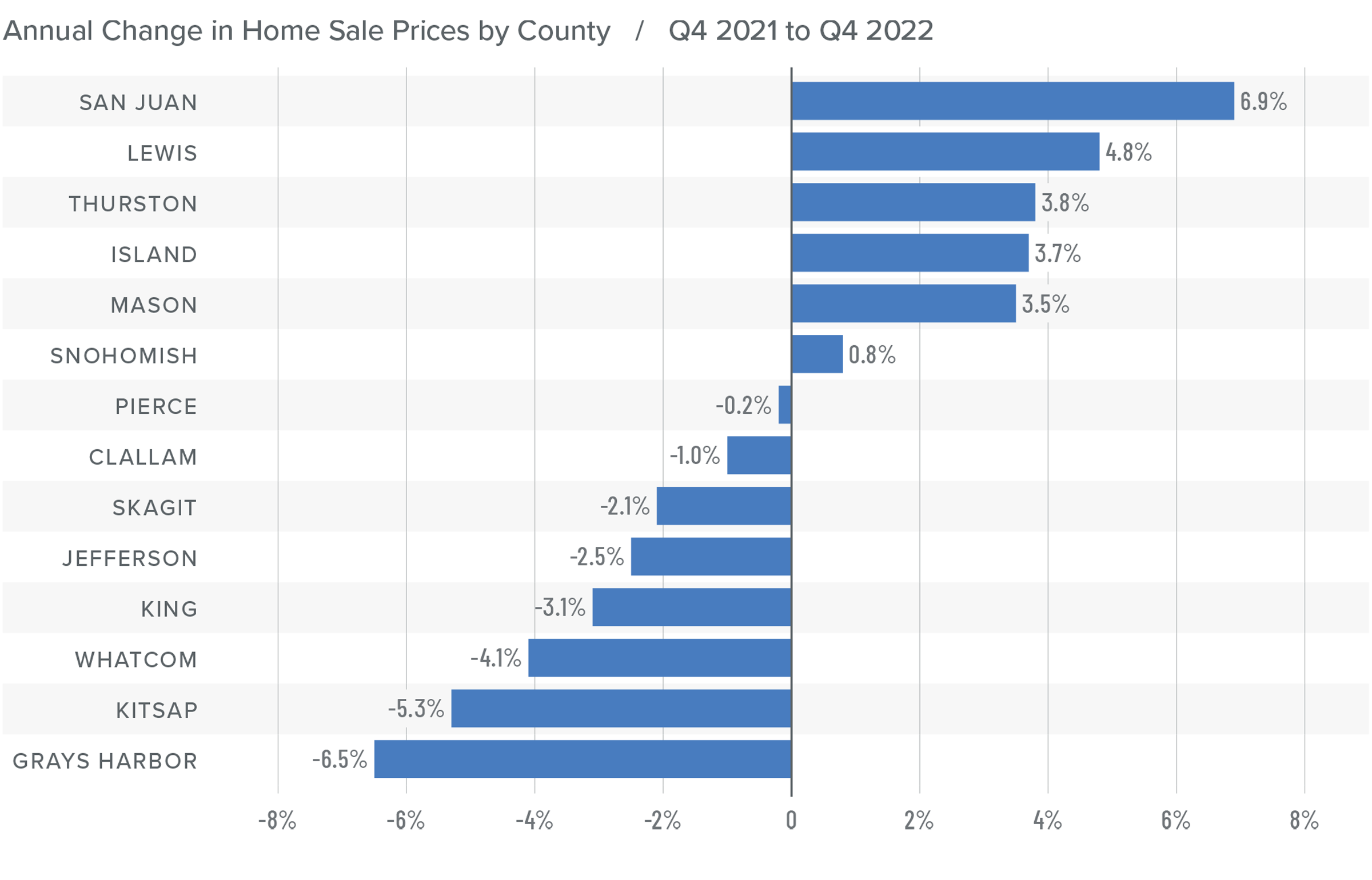

Western Washington Home Prices

❱ Sale prices fell an average of 2% compared to the same period the year prior and were 6.1% lower than in the third quarter of 2022. The average sale price was $702,653.

❱ The median listing price in the fourth quarter of 2022 was 5% lower than in the third quarter. Only Skagit County experienced higher asking prices. Clearly, sellers are starting to be more realistic about the shift in the market.

❱ Even though the region saw aggregate prices fall, prices rose in six counties year over year.

❱ Much will be said about the drop in prices, but I am not overly concerned. Like most of the country, the Western Washington market went through a period of artificially low borrowing costs, which caused home values to soar. But now prices are trending back to more normalized levels, which I believe is a good thing.

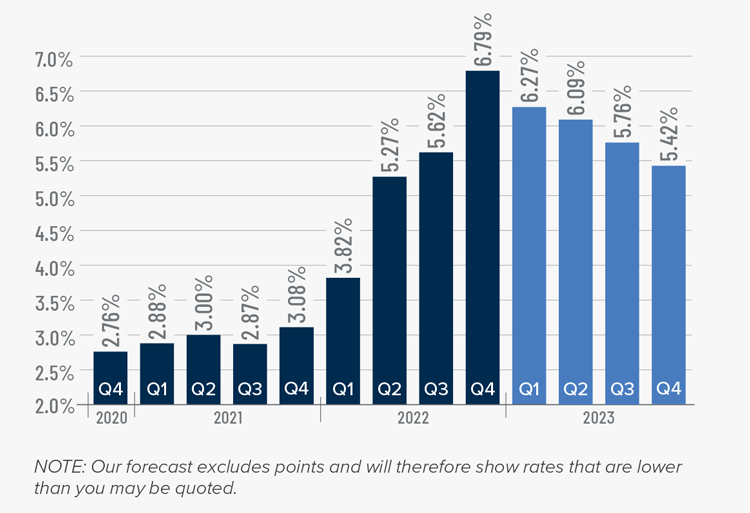

Mortgage Rates

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets such as Western Washington will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

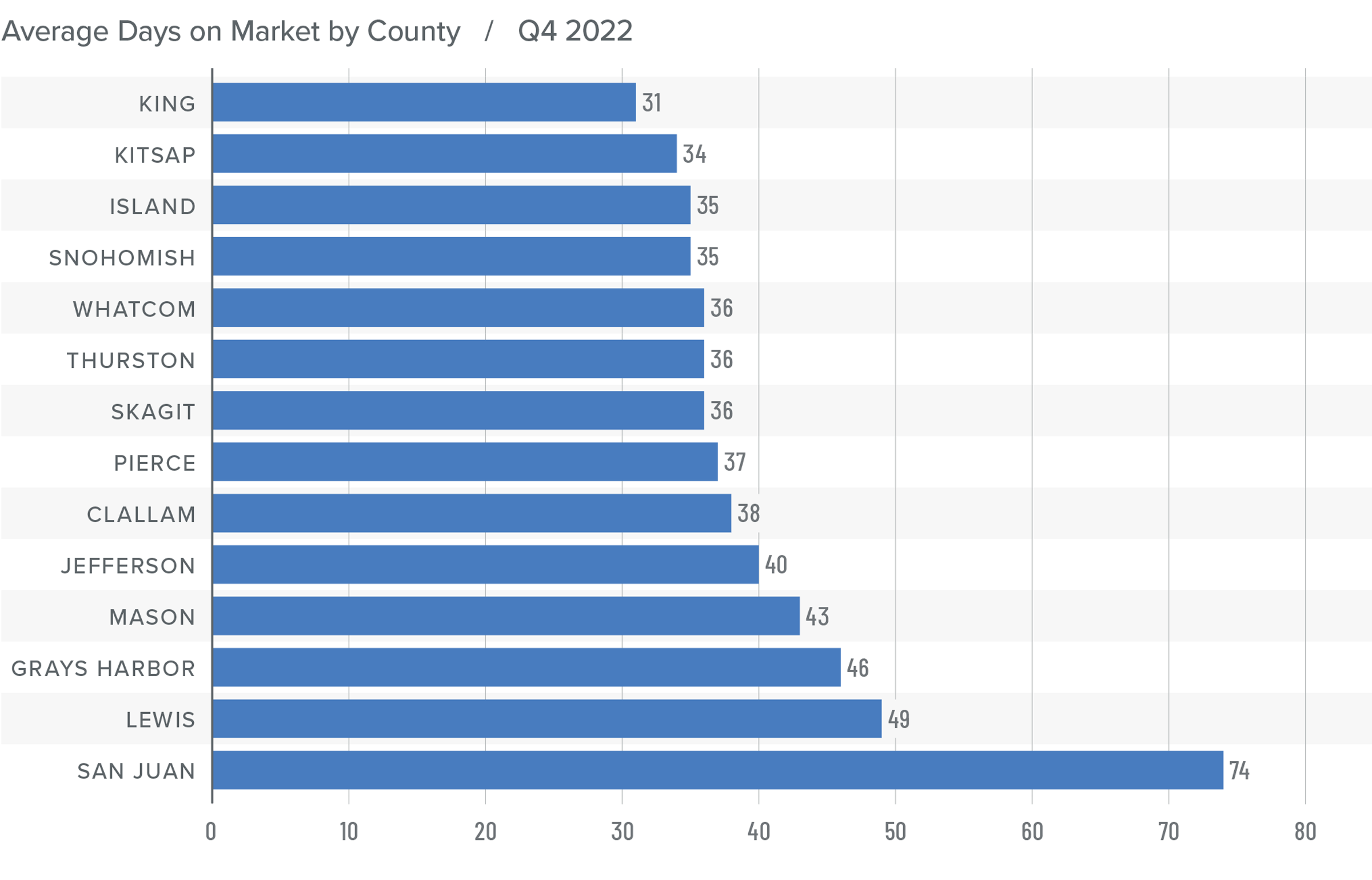

Western Washington Days on Market

❱ It took an average of 41 days for homes to sell in the fourth quarter of 2022. This was 17 more days than in the same quarter of 2021, and 16 days more than in the third quarter of 2022.

❱ King County was again the tightest market in Western Washington, with homes taking an average of 31 days to find a buyer.

❱ All counties contained in this report saw the average time on market rise from the same period a year ago.

❱ Year over year, the greatest increase in market time was Snohomish County, where it took an average of 23 more days to find a buyer. Compared to the third quarter of 2022, San Juan County saw average market time rise the most (from 34 to 74 days).

Conclusions

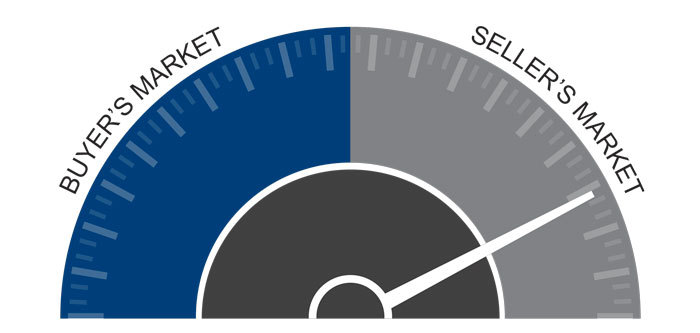

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The regional economy is still growing, but it is showing signs of slowing. Although this is not an immediate concern, if employees start to worry about job security, they may decide to wait before making the decision to buy or sell a home. As we move through the spring I believe the market will be fairly soft, but I would caution buyers who think conditions are completely shifting in their direction. Due to the large number of homeowners who have a mortgage at 3% or lower, I simply don’t believe the market will become oversupplied with inventory, which will keep home values from dropping too significantly.

Ultimately, however, the market will benefit buyers more than sellers, at least for the time being. As such, I have moved the needle as close to the balance line as we have seen in a very long time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This article originally appeared on the Windermere blog January 26th, 2023. Written by: Matthew Gardner.

© Copyright 2023, Windermere Real Estate/Mercer Island.

Economic Insights from Matthew Gardner

As we all hunker down through these challenging times, it is comforting to remember that there will be light at the end of the tunnel.

A voice of calm and reason in this time of uncertainty has been our Windermere Chief Economist, Matthew Gardner. While he is expecting an economic slowdown accompanied by a temporary 15-20% reduction in the number of homes sold, he believes the housing market will bounce back once we find our new normal.

Click here to watch his latest videos, or scroll down for some key takeaways…

The US economy will contract sharply but should perk up by Q4.

We’re in for a rough few quarters as the economy enters a recession. Just how rough—and how long—is still under debate. What economists do agree on is that the 4th quarter is looking remarkably positive…assuming we get through the COVID-19 crisis and the economy can resume somewhat normal activity before the fall.

![]()

Housing prices will likely remain stable.

Seattle home prices should remain steady—or even rise slowly as we come out of the recession—for a few reasons:

- DIVERSE INDUSTRIES IN OUR AREA which allow us to better weather the economic storm.

- SOLID FINANCIAL FOOTING as one third of local home owners have 50% or greater equity in their homes.

- STRONG DEMAND with more buyers than homes available, as well as rock-bottom interest rates.

![]()

This will be different than 2008…

We’re experiencing a health crisis, not a housing crisis.

- WE’LL SEE A PAUSE, NOT A COLLAPSE. Unlike last time, the housing market was strong going into this crisis and should rebound quickly. Why? Because this recession will be due to specific external factors rather than any fundamental problem with the housing market.

- FORECLOSURES WILL BE FEWER with most lenders offering relief to homeowners in distress due to temporary employment issues. Unlike 2008’s mortgage crisis caused by lax lending standards and low down payments, today’s home owners are better qualified and have more equity in their homes.

![]()

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

© Copyright 2020, Windermere Real Estate / Mercer Island

Baby Boomers: Impact on the U.S. Housing Market

Originally posted on Windermere Blog.

75 million Baby Boomers control nearly 80% of all U.S. wealth, and as this generation ages, retires, and inevitably downsizes, they will have a significant impact on the housing market. Windermere’s Chief Economist, Matthew Gardner, explains when we can expect to see Boomers start to sell, opening much-needed inventory and making home ownership available to younger generations.

2017 Real Estate Forecast

Matthew Gardner, chief economist for Windermere Real Estate, was one of the presenters at this year’s Eastside Windermere Real Estate Kick Off I attended. I eagerly look forward to his forecast, because it is always so packed with useful information. And I love sharing it with you!

Matthew Gardner, chief economist for Windermere Real Estate, was one of the presenters at this year’s Eastside Windermere Real Estate Kick Off I attended. I eagerly look forward to his forecast, because it is always so packed with useful information. And I love sharing it with you!

He covered our local economy – which is experiencing remarkable growth. The economies of the metros located in the western United States have been strong, and Washington State metro areas are currently at the top of this group. Mr. Gardner expects this economic trend to continue in 2017, along with low unemployment. The Seattle region should maintain a robust influx of people relocating here during 2017 to fill jobs in the tech sector, and escape higher priced real estate in California, especially the Bay area.

Mr. Gardner showed an interesting chart detailing the most successful spin-off companies that derived from Microsoft. He expects the same thing to occur from the talent being hired by Amazon. He said that Amazon hires more MBAs than any other company in the world, which translates into positive economic implications for our regional business environment.

Any slowdowns reported on the employment front have been due to everyone who wants a job are already employed, a trend that will continue this year with the projected generation of new jobs. Post-recession sectors in our area seeing noteworthy growth, in addition to the tech industry, are retail and leisure. With our low unemployment numbers, Mr. Gardner said that when unemployment drops under 4% (King County’s unemployment rate in November 2016 was at 3.9%), we start seeing pay increase to retain employees. He projected a 4.5% growth in income during 2017.

Two sectors he noted as slower growing are manufacturing and construction. We’re seeing that trend play out in lower numbers of single family residential permits being issued. The lack of new construction places pressure on our regional resale market, which will contribute to our housing market’s continued low inventory in 2017.

Western Washington home prices will experience continued growth this year. Mr. Gardner did stress that housing affordability is an issue that needs to be addressed. King County homes are not affordable for many first time home buyers, which is driving homebuyers to purchase outside of larger King Country cities. He mentioned the trend of people communting from bedroom communities like Marysville and Cle Elum to their jobs in Seattle and Bellevue. Some commuters are even opting to purchase homes in Spokane, where real estate is much more affordable than in Western Washington, and then bulk buying airplane tickets to fly back and forth weekly from their jobs on the west side of the mountains to their homes in Spokane.

The change in the presidential administration was also discussed. Mr. Gardner forecast that this change won’t affect our housing market in 2017. He stated it takes time for rhetoric to become policy. In the Seattle area we should see a seller’s market persist this year, increases in home prices, and continual job growth in the next 12 months.

Photo credit: Frances Gaul

Making sense out of the market

With the continued low inventory around Seattle and the Greater Eastside, how do our regional housing sales continue to grow? In his recently released 3rd quarter report, Windermere Real Estate’s chief economist, Matthew Gardner, pointed out that there has been an uptick in the number of 1st time home buyers purchasing homes. Svenja Gudell, Zillow’s chief economist, stated in her 3rd quarter report that during 2016 almost half of all U.S. buyers were first time home buyers.

With the continued low inventory around Seattle and the Greater Eastside, how do our regional housing sales continue to grow? In his recently released 3rd quarter report, Windermere Real Estate’s chief economist, Matthew Gardner, pointed out that there has been an uptick in the number of 1st time home buyers purchasing homes. Svenja Gudell, Zillow’s chief economist, stated in her 3rd quarter report that during 2016 almost half of all U.S. buyers were first time home buyers.

However, we’re also seeing the prices of starter homes skyrocket in our area. The recently released S&P Case-Shiller Home Price Index pinpointed that the Seattle area has the 2nd fastest-rising home prices in the nation. In fact, since 2012 the starter home prices have jumped 75% compared the overall housing market increases at 59% for the same time period. Millennial home buyers are ready to purchase their first homes, but starter homes are not what they used to be.

Additionally, homes in the luxury price points are seeing a slowing in their price gain in our region. According to the Case-Shiller Home Price Index report Seattle area luxury homes had a price gain of 10.9%, compared to the least expensive homes that experienced a 12.9% gain during the same report time period.

With so many differing factors working to shape our regional housing market conditions, it can be confusing to keep track of what is going on in your neighborhood, or how to make comparisons between communities that you may want to call home. I work diligently to maintain a pulse on the workings of our real estate market, to be an educated resource for you to utilize. Please give me a call with any questions you may have regarding home pricing, real estate investment, or making your first home purchase.

What We Know (and Don’t Know) About the Impact of Brexit

This blog post authored by Matthew Gardner originally appears on Windermere Blog on June 27, 2016.

The decision of the British public to leave the European Union is a historic one for many reasons, not least of which was the almost uniform belief that there was absolutely no way that the public would vote to dissolve a partnership that had been in existence since the UK became a member nation back in 1973. However, rightly or not, the people decided that it was time to leave.

As both an economist, and native of the UK, I’ve been bombarded with questions from people about what impact Brexit will have on the global economy and U.S. housing market. I’ll start with the economy.

Since last Thursday’s announcement, there have been exceptional ripples around the global economy that were felt here in the U.S. too. This isn’t all that surprising given that the vast majority of us believed that the UK would vote to remain in the EU; however, I believe things will start to settle down as soon as the smoke clears. The only problem is that the smoke remains remarkably dense.

The British government does not appear to be in any hurry to invoke Article 50 of the Lisbon Treaty, which allows a member country to leave the conglomerate. Additionally, nobody appears able to provide any definitive data as to what the effect of the UK leaving will really have on the European or global economies.

As a result, you have those who suggest that it will lead to a “modest” recession in the UK, as well as extremists who are forecasting a return of the 4-horsemen of the apocalypse. But in reality, no one really knows, and it is that type of uncertainty that feeds on itself and can cause wild fluctuations in the market.

It’s important to understand that last Thursday’s vote does not confirm an actual exit from the European Union. There is a prolonged process of leaving that is set out in the EU Treaty which requires a “cooling off” period. And during this time, even confident political leaders, such as Boris Johnson who championed the exit campaign, might be tempted by reforms that would see Great Britain actually remaining in the EU.

The EU itself has been shaken by the vote, and there are already signs that many of its leaders are talking about moving away from the Federal structure of the Union in favor of a looser, intergovernmental agreement, that would allow greater sovereignty for its member states.

This is clearly an obvious attempt to accommodate what is already a groundswell of opposition to the Union that is much wider than just Britain, and now includes France, Spain, Greece and Portugal, all of whom are considering their own exits.

So what does this mean for the U.S.?

As far as any direct impact of the Brexit on the U.S. economy is concerned, I foresee a continued period of volatility given the aforementioned uncertainty. That said, any predictable effects on the U.S. will be limited to a “headwind” to growth, but not enough to drive us into a recession. Our financial system is solid and U.S. exposure to European debt is still limited. I wouldn’t be surprised to see a slowdown in U.S. exports as the dollar continues to gain strength against European currencies, but those effects will be fairly modest.

As for the impact on housing, U.S. real estate markets could actually benefit. Uncertain economic times almost always lead to a “flight to safety”, which means global capital could pour into the United States bond market at an aggressive rate. With this capital injection, the interest rate on bonds would be driven down, resulting in a drop on mortgage rates. And a drop in mortgage rates makes it cheaper to borrow money to buy a home.

On the flip side, one thing that concerns me about lower interest rates is that it could draw more buyers into the market, compounding already competitive conditions, and driving up home prices. And housing affordability would inevitably take yet another hit.

Let’s not fool ourselves; what we’re seeing is a divorce between the UK and a majority of Europe. And like most divorces, there are no good decisions that will make everybody happy. We need to be prepared for the fact that it is going to be a very ugly, nasty, brutal, lawyer-riddled, expensive divorce.

My biggest concern for the U.S. is that the Federal Reserve must now pause in its desire to raise interest rates (I now believe that we will not see another increase this year as a result of Brexit). This is troubling because we need to normalize rates in preparation for a recession that is surely on the way in the next couple of years. The longer we put that off, the less prepared we will be when our economy eventually turns down.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Matthew Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Historically low inventory levels, how we got here, & what to expect in the coming year [Video]

Originally posted on Windermere Blog

The housing market is performing remarkably well, with the exception of incredibly low inventory levels in many areas throughout the country. Why is this happening? Windermere’s Chief Economist, Matthew Gardner, explains why and offers his predictions for what we can expect in the future.

Economic & Housing Outlook for the Puget Sound Region

I recently attended two highly informative events where Windermere’s Chief Economist, Matthew Gardner, covered the economic and housing outlook for our region. Mr. Gardner shared that the economic landscape for the greater Seattle area is quite good. Our unemployment and rate of inflation are both low. He stated that we need to see more diversification in the job offerings in our region – we’re a bit too reliant on Amazon, which is the leading company creating jobs and our need for more housing inventory. Wage discrepancy and the level of part time employees searching for full time work is also an issue. Add in the current home pricing in King County plus the rapid rise of rents, and there is a segment of Seattle Metro buyers who are priced out the market and are looking in other counties for housing. The Tacoma area is increasingly where buyers are choosing to make home purchases. Home pricing and local economics are also affecting the number of 1st time move-up buyers. They are opting to remain in place for now, which has definitely made an impact on the number of homes being listed for sale.

I recently attended two highly informative events where Windermere’s Chief Economist, Matthew Gardner, covered the economic and housing outlook for our region. Mr. Gardner shared that the economic landscape for the greater Seattle area is quite good. Our unemployment and rate of inflation are both low. He stated that we need to see more diversification in the job offerings in our region – we’re a bit too reliant on Amazon, which is the leading company creating jobs and our need for more housing inventory. Wage discrepancy and the level of part time employees searching for full time work is also an issue. Add in the current home pricing in King County plus the rapid rise of rents, and there is a segment of Seattle Metro buyers who are priced out the market and are looking in other counties for housing. The Tacoma area is increasingly where buyers are choosing to make home purchases. Home pricing and local economics are also affecting the number of 1st time move-up buyers. They are opting to remain in place for now, which has definitely made an impact on the number of homes being listed for sale.

The flip side of the current price of homes is the positive equity being generated for today’s Seattle Metro homeowners. This positive equity should motivate more sellers to enter the housing market, and give us the desperately needed housing inventory our market needs. Fixed rate mortgages will remain low during 2016, although there is a misconception among 1st time home buyers that a 4% 30 year fixed mortgage rate is too high. Think back to 1982 when buyers faced an 18% mortgage rate! 4% is a dream in comparison.

Supply in the high end real estate market is tight in our region and will remain so during 2016. Luxury real estate buyers are able to take advantage of fantastic jumbo loan options currently, as long as they can find the home of their dreams to purchase. There is definitely some good news in the horizon that may increase the inventory of luxury real estate in the greater Seattle area. It is projected more high end spec builders will experience improved access to financing options from lenders this year.

With 2016 being an election year, Mr. Gardner projected no large surprises in housing or economics looming. Typically, election years are fairly benign and 2016 promises to follow in a similar vein. If you have any questions on our regional housing market, or about your home’s current value, please give me a call at 206-412-0038 or send me an email at marianne@windermere.com so I can answer your questions.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link